|

| November 17, 2015 | Volume 11 Issue 43 |

Designfax weekly eMagazine

Archives

Partners

Manufacturing Center

Product Spotlight

Modern Applications News

Metalworking Ideas For

Today's Job Shops

Tooling and Production

Strategies for large

metalworking plants

Material Wars: Who's going to win the automotive metals race?

By David Paratore, President and Chief Executive Officer, NanoSteel

There's a lot of press out there about new materials replacing sheet steel in the automotive industry. Aluminum and composites are being touted as the next best things for taking weight out of cars. With the federal fuel economy deadline of 54.5 mpg by 2025 looming, the battle is on.

Lightweighting, apart from its contribution to fuel economy, provides other advantages to automakers: an opportunity to increase efficiency by decreasing the size and weight of engines and suspensions, to raise the payload, and to add in more safety features and infotainment options. Evolving from beer cans to the aluminum body of an F150 truck, or from the composite skin of a Stealth jet to the BMW i8 street hybrid, other lightweight materials are clearly making their way into mainstream automotive.

A car body-in-white in advanced lightweight steel.

Steel companies are not ignoring this lightweighting trend. Far from it: Steel manufacturers have a long history of responsiveness to the auto industry. As a result, current generations of automotive steels are now competitive in weight savings with other metals, able to provide all the advantages that lightweighting brings.

So, in my opinion, any rumors of the demise of steel are greatly exaggerated. In fact, I would say that steel for automotive is on the verge of a rebirth.

Why is that? Because, simply stated, cars will always be made out of materials with performance characteristics that the auto OEMs demand -- from manufacturers who can provide them at the right price. And the steel industry is on the cusp of providing OEMs with the next generation of advanced high-strength steels (AHSS) that will ensure that the material continues to play a pivotal role in the majority of vehicles for the foreseeable future.

But to be fair, steel is not alone. I predict that some of the current drawbacks of aluminum -- it costs more to manufacture car parts from, and it's expensive to repair -- will be somewhat mitigated over the next 10 to 20 years as factories and shops get up and running on the associated technology. In contrast, I think the cost and production challenges of composites make them a much longer-term play for anything in the high-volume arena.

Where will this metals "battleground" play out? Ten years from now, I see the body-in-white (BIW, the pillars and structures) being mostly steel. Steel just makes sense for structural parts because it has traditionally held an edge over aluminum in strength, stiffness, and energy absorption, and the release of new steels will extend that advantage. On the other hand, closures (doors, hoods, deck lids) and some outer skin panels will be a place where steel will have to battle with aluminum to hold onto market share.

And which raw material costs less? Steel. By far.

What's more, the newest steels can be made into auto parts with the same room-temperature stamping lines as previous generations. That's a really big deal. Industry won't have to reinvest in new capital equipment. And existing employees already have the manufacturing skills.

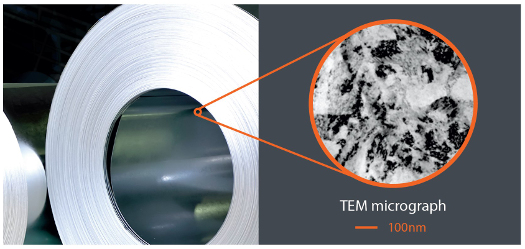

A roll of sheet steel (left) and a micrograph of its material structure (right).

Why are these innovative materials emerging now? Because the automakers have asked for them. The steel industry is adjusting its output to those requests as it has always done. More than half the grades of steel that are in cars today didn't exist 15 to 20 years ago; they were invented specifically for automotive applications.

In our company, we've been working in partnership with GM and other automakers for several years to develop alloys that can be universally produced and available. This is critical because the increasing globalization of the automotive industry will be a challenge for a regionally focused supply base.

Platform consolidation is a large theme in the industry, with automakers trying to dramatically reduce the number of different vehicle platforms they need to design and invest in. If you are creating a global platform, with a standardized design at the core of the vehicle, you are going to want to make just one common body-in-white. That BIW is going to be designed assuming a specific set of alloys. But you need to have those alloys available no matter where you're producing the car. A globally licensed grade of easily produced, third-generation AHSS -- with consistent, replicable properties -- will fulfill that need.

A number of smart people are out there working to commercialize third-generation AHSS. Most steel companies are creating solutions through processing, attempting to get different properties out of known alloys through different heat treatments or rolling techniques.

But some innovators are taking a fundamentally different route to enhanced performance characteristics by customizing the structure of steel alloys at the deepest molecular levels. Such value-added, proprietary technology represents an exciting option for steelmakers -- and OEMs -- to identify promising materials solutions that can meet future challenges in the automotive industry.

Steel remains king in bridges and buildings. In the automotive arena, steel can be the agent of its own destiny as the prospect for profound breakthroughs draws increasingly closer. Stay tuned. You'll be amazed to see what steel comes up with next as the business of carmaking becomes increasingly global.

About the author

David Paratore is the President and Chief Executive Officer of NanoSteel, an advanced materials company specializing in the design of new grades of formable advanced high-strength sheet steels for vehicle lightweighting. Previously, Paratore was president and COO of American Superconductor after having held several leadership positions in United Technologies - Pratt & Whitney Aircraft Engines. Paratore has a BS in mechanical engineering from University of Massachusetts Amherst and an MBA from Rensselaer Polytechnical Institute.

[This article first appeared in Industry Week July 9, 2015]

Published November 2015

Rate this article

View our terms of use and privacy policy